Multi-Divergence Overlap works with oscillator inputs of your choice. You can get the whole bundle at better price below.

Multiple Divergence – the power of consensus

Multi-Divergence Overlap uncovers reversal zones that single indicators miss – powered by consensus between unlimited oscillators.

What can this indicator do?

Multi-Divergence Overlap analyzes divergence consensus between multiple oscillators and price, confirming only when several agree. This consensus-based logic filters noise, removes weak signals, and highlights high-probability turning points.

Unlimited oscillator consensus

Combine as many oscillators as you like – RSI, MACD, CCI, Momentum, OBV, Stochastic, MFI, and more – to create your own personalized divergence confluence model.

Independent analysis

Each oscillator is analyzed separately against price to find its own divergence, ensuring unbiased signals with no blending or averaging.

Unified confluence layer

After all analyses, MDO confirms and plots only when multiple divergences overlap in the same price region – revealing true market agreement.

Dual Divergence mode

Detect both regular (reversal) and hidden (continuation) divergences. Use either mode or combine both for complete market coverage.

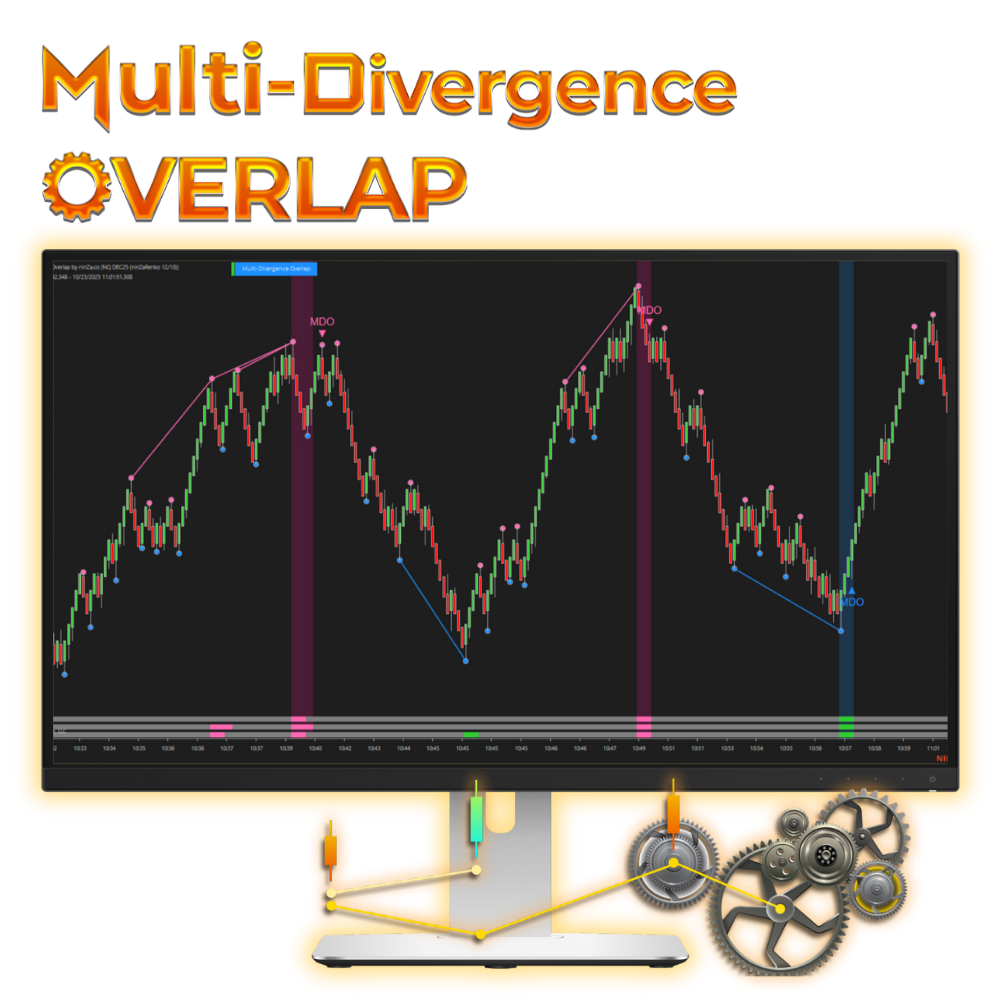

How Multi-Divergence Overlap works

Scanning phase

Each oscillator – RSI, MACD, CCI, Momentum, OBV, Stochastic, MFI, and others – is analyzed individually against price to detect its own divergence patterns.

This independent analysis ensures every oscillator provides unbiased, standalone input to the overall model.

Consensus phase

When multiple oscillators signal divergence in the same direction (bullish or bearish) and within the same price region, MDO confirms a divergence overlap – a strong agreement zone formed by several independent tools.

Signal display

Only these high-confidence confluence signals are plotted, keeping your chart clean and focused on the most statistically reliable trading opportunities.

Divergence. Reversal. Strength

All-in-one bundle

This special bundle combines 3 professional-grade indicators that work together to deliver unmatched precision and confidence in your trading decisions.

It detects where multiple oscillators – RSI, MACD, CCI, Momentum, OBV, Stochastic, MFI, etc. – show divergence with price at the same time and in the same region.This consensus model filters out weak, isolated divergences and highlights true confluence zones, giving early warnings of potential reversals or continuations with far greater reliability.

Inspired by Larry Williams’ %R, DWIN Reversal shows where current price stands within its recent range – clearly revealing when the market is nearing exhaustion or opportunity.Used with Multi-Divergence Overlap, it acts as a real-time trigger, confirming whether divergence zones align with range extremes.

An advanced version of the classic RSI that improves responsiveness and reduces noise.

It provides a smoother, more accurate view of momentum and trend strength.Combined with these 2 indicators, it becomes the final confirmation layer, verifying whether momentum supports the setup and helping avoid false reversals.

The original price of Multi-Divergence Overlap is $746, but you can save more...

Core power option

$346 ($746)

(1) Multi-Divergence Overlap license

Trader's manual

Priority support

Premium bundle

$426 ($1,550)

(1) Multi-Divergence Overlap license

(1) DWIN Reversal license

(1) Superior RSI license

Checklist

Priority support